Swiggy’s Anticipated IPO: A $15 Billion Valuation in the Making

Technical Analysis of BreakOut Stocks for Short Term Trading – December 17, 2021 - Havells, Dabur India

Last Updated: 7th September 2023 - 05:09 pm

Read here about breakout stocks, its meaning and what are the breakout stocks for today.

Breakout Stocks: What are the breakout stocks for today?

A breakout is a phase where stock price moves outside a consolidation with increased volumes. Such breakouts generally lead to good price movement in short term and this is one of the proven method for selecting buy best share to trade for short term. In this column, we inform our readers the breakout stocks today which can be considered as best short term stocks.

We cover the stocks which have given a breakout from the resistance or stocks which have broken their important support levels. Shares which given a breakout above its resistance with good volumes should be referred for bullish trades which stocks which breaks their supports should be referred for bearish trades.

The stocks given are for reference and traders are advised to take their own decision and trade with proper money management.

Today, we have picked two stocks which have given a breakout (or breakdown) from a consolidation phase as per technical analysis.

Best Stocks to Trade for Short Term

1. Havells (HAVELLS):

Image Source: Falcon

The ‘Higher Top Higher Bottom’ structure on the daily chart of Havells ended during mid-October when the stock corrected and broke its swing low. Prices had seen a pullback from the low of Rs. 1210 but they had formed a ‘Lower High’. If we draw a trendline joining the swing highs and the swing lows, it seen that the stock has consolidated into a ‘Symmetrical Triangle’ pattern. The prices have broken the lower trendline which indicates a bearish structure for the short term. Hence, we expect the prices to correct in the near term. Traders can look to trade with a negative bias and sell in the range of 1320-1330 for a potential targets around Rs. 1290 followed by Rs. 1245. The pattern gets negated if the prices break above Rs. 1360.

Havells Share Price Target -

Sell Price – Rs.1,320 - Rs.1,330

Stop Loss – Rs.1,360

Target Price 1 – Rs.1,290

Target Price 2 - Rs.1,245

Holding Period – 1 - 2 weeks

(Cash levels given for reference)

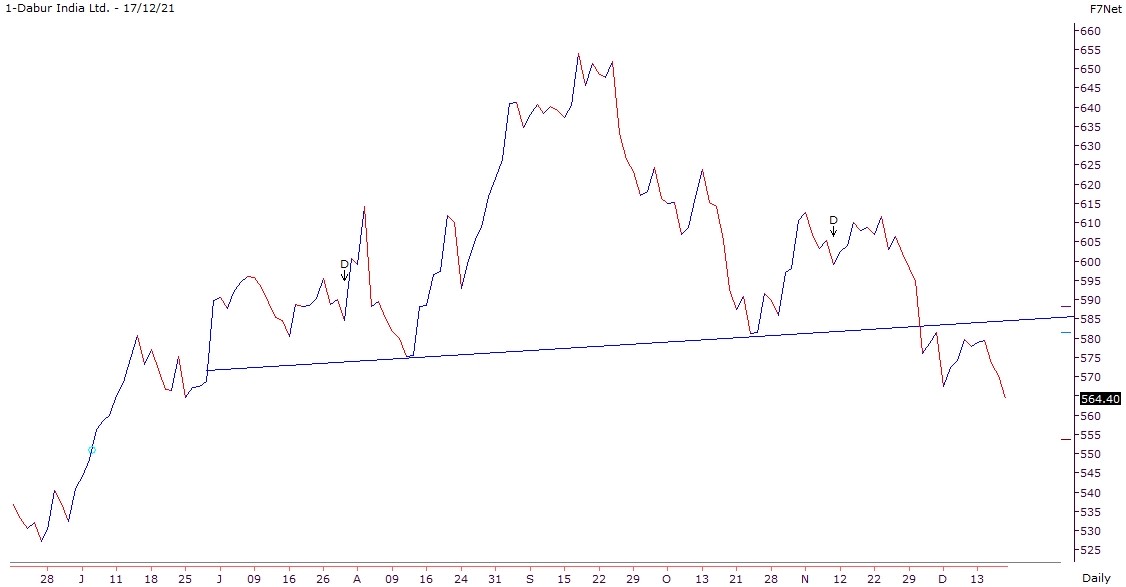

2. Dabur India (DABUR):

The FMCG space has recently underperformed and had witnessed selling pressure in last couple of months. If we see the positional charts of Dabur, it is seen that the stock has given formed a ‘Head and Shoulders’ pattern on the daily chart and prices have broken the neckline support of the pattern. In technical analysis, this pattern when formed after an uptrend signals a trend reversal and hence is seen as a bearish sign. The recent pullback witnessed selling pressure and hence, the technical set up is bearish for the short term.

Hence, we expect the prices to correct in the near term. Traders can look to trade with a negative bias and sell in the range of 565-570 for a potential targets around Rs. 545 followed by Rs. 532. The pattern gets negated if the prices break above Rs. 584.

Dabur India Share Price Target -

Sell Price – Rs.560 - Rs.570

Stop Loss – Rs.584

Target Price 1 – Rs.545

Target Price 2 - Rs.532

Holding Period – 1 - 2 weeks

(Cash levels given for reference)

Disclaimer:The investments discussed or recommended may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and only after consulting such independent advisors as may be necessary.

Trending on 5paisa

Discover more of what matters to you.

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Ruchit Jain

Ruchit Jain Sachin Gupta

Sachin Gupta Tanushree Jaiswal

Tanushree Jaiswal