Weekly Outlook on Crude Oil - 4 Nov 2022

Last Updated: 10th December 2022 - 05:18 pm

Crude oil prices opened in negative territory on Monday amid concerns about the outlook for energy demand from China due to a surge in Covid-19 cases. However, from Tuesday, oil prices rose again, gaining ground even as other risk assets dropped following the fourth interest rate hike in a year by the Federal Reserve. The prices were also supported by another decline in U.S. inventories data ahead of the winter heating season.

Overall, WTI oil prices traded positively for most part of the week and set a weekly high of $90.56 on Friday, but gains were capped by recession fears and COVID concerns in China. Brent oil rose 1.84% to $96.37 a barrel on Friday's session.

Weekly outlook on Crude Oil

On the NYMEX division, the WTI Crude oil prices reversed from the immediate support of 50-day Simple Moving Averages and the Ichimoku Cloud formation, which suggests further strength in the counter. Moreover, the prices are hovering near to the Trendline breakout zone above $91; it may continue the uptrend for the near term. An indicator Stochastic & CCI indicates positive crossover on the daily timeframe. However, the ongoing fundamentals are not supporting the prices that could cap the long rally in the counter. Hence, we are expecting a sideways to bullish move WTI Crude Oil for the coming week. The further support is at the $85.30 and the $78 mark while resistance stood at $95.60/99.30 levels.

On the MCX front, crude oil prices gained more than 3% over a week and traded near 7450 on Friday's session. On the weekly chart, the price has moved above the prior week's high with good volume activity that indicates bullish strength for the near term. Overall, the price has been moving in a broader range for the last four weeks that point out no clear view among the traders. However, the prices are still trading above 38.2% Retracement Levels and cheering for the next upside leg. Hence, we expect a sideways to bullish move in crude oil for the week. On the downside, it is holding the support at Rs.7080 and Rs.6760 levels, while on the upside; it may find resistance at Rs.7700 and 8050 levels.

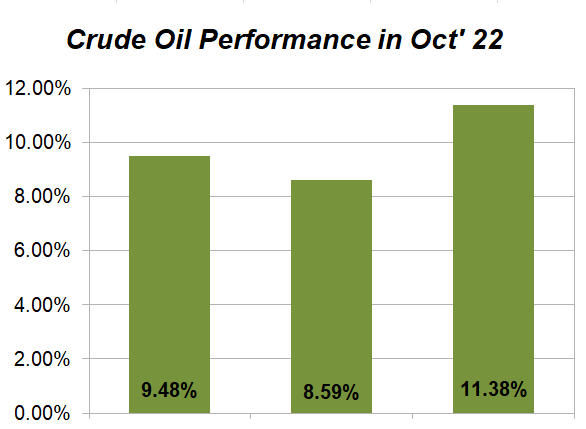

Crude Oil Price Performance for October’22 :

Important Key Levels:

|

MCX CRUDE OIL (Rs.) |

WTI CRUDE OIL ($) |

|

|

Support 1 |

7080 |

85.30 |

|

Support 2 |

6760 |

78 |

|

Resistance 1 |

7700 |

95.60 |

|

Resistance 2 |

8050 |

99.30 |

Disclaimer: Investment/Trading in securities Market is subject to market risk, past performance is not a guarantee of future performance. The risk of loss in trading and investment in Securities markets including Equites and Derivatives can be substantial.

Trending on 5paisa

Discover more of what matters to you.

Commodities Related Articles

Sachin Gupta

Sachin Gupta Ruchit Jain

Ruchit Jain Tanushree Jaiswal

Tanushree Jaiswal