Weekly Outlook on Gold - 23 Dec 2022

Last Updated: 23rd December 2022 - 06:27 pm

Gold prices rose as sentiments remained clouded by worries that aggressive interest rates could lead to an economic recession in the U.S. Prices also gained this week against the weaker dollar, which was in part dented by a less dovish than expected stance from the Bank of Japan.

However, investors were focusing on the GDP & jobs data, which was more positive than expected, released on Thursday, after that we witnessed some profit booking in the yellow metals.

The prospect of rising interest rates in developed markets is likely to keep gold prices subdued in the coming months, with the Bank of Japan, the European Central Bank, and the Bank of England also sending hawkish messages.

Weekly outlook on Gold

On the COMEX division, gold has taken resistance around 50% Retracement Levels and failed to surpass $1850, which suggests an immediate hurdle for prices. Moreover, the price has also reversed from the Upper Bollinger Band formation. An indicator of Stochastic and CCI witnessed a negative crossover on the daily chart. So, for the coming week, the price could show some corrections. On the downside, it may find support around $1765 and $1730 levels while, on the upside, it may face resistance at $1838 and $1855 marks.

On the MCX front, the gold prices were unable to surpass the prior resistance of 55558 and corrected almost 800 points from the high of 55220 till Friday noon. Overall, prices gained by 0.5% over a week and traded around Rs. 54560 on Friday's session. On the daily timeframe, the price has reached its eight-month high since Mar 22, then corrected from the third point reversal zone, which acts as an immediate hurdle for prices. A momentum indicator RSI & MACD witnessed negative crossover on the daily chart. However, other indicators like Ichimoku Cloud, Bollinger and CCI are still on the positive side that suggests limited downside movement in prices.

Hence, we are expecting a sideways to bearish move in the gold, until it sustains above 55200 levels. One can look for a short position for the target of Rs. 54000 & Rs. 53700. On the higher side, Rs. 55200 & Rs. 55800 will act as resistance zones for the prices.

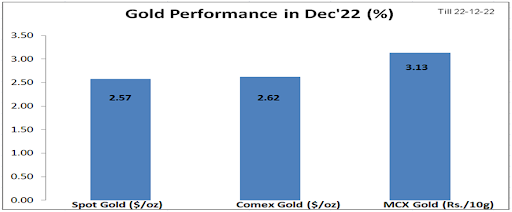

GOLD PERFORMANCE:

Important Key Levels:

|

MCX GOLD (Rs.) |

COMEX GOLD ($) |

|

|

Support 1 |

53700 |

1765 |

|

Support 2 |

53000 |

1730 |

|

Resistance 1 |

55200 |

1838 |

|

Resistance 2 |

55800 |

1855 |

Disclaimer: Investment/Trading in securities Market is subject to market risk, past performance is not a guarantee of future performance. The risk of loss in trading and investment in Securities markets including Equites and Derivatives can be substantial.

Trending on 5paisa

Discover more of what matters to you.

Commodities Related Articles

Sachin Gupta

Sachin Gupta Ruchit Jain

Ruchit Jain Tanushree Jaiswal

Tanushree Jaiswal