Top Banks Senior Citizen FD Interest Rates

Best FMCG Stocks

Last Updated: 7th September 2023 - 05:09 pm

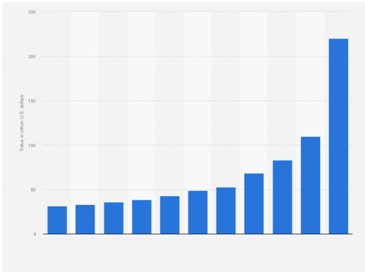

The Fast Moving Consumer Goods (FMCG) business has experienced enormous expansion over the years and is a key component of the Indian economy. The FMCG industry in India is anticipated to expand quickly in 2023 due to factors like escalating urbanization, rising incomes, and shifting customer tastes. The best FMCG stocks in India are discussed in this article.

What are FMCG Stocks?

Shares of businesses that manufacture and market fast-moving consumer goods, such as food and drinks, personal care items, basic household items, and other inexpensive commodities with a limited shelf life, are known as FMCG stocks. Because of their steady demand and potential for big profits, these equities are top FMCG stocks well-liked by investors.

Overview of the FMCG Industry

Fast-moving consumer goods (FMCG) are purchased frequently and for little money. They contain prepackaged foods, drinks, toiletries, cosmetics, and cleaning supplies. Best FMCG stocks in India are known for their fierce competitiveness, with businesses frequently engaging in price wars and aggressive marketing campaigns. The market of best FMCG stocks in India is significantly influenced by consumer trends and needs, continually changing to accommodate shifting lifestyles and preferences.

Why Invest in FMCG Stocks?

Investors can decide FMCG stocks to buy by considering reasons, such as-

● The FMCG sector is stable and less volatile than other businesses. It is because, during economic downturns, people frequently buy necessities like food, beverages, and personal care products.

● Many FMCG company stocks enjoy great consumer loyalty and brand recognition, which can result in steady revenue growth. They are therefore appealing to investors looking for revenue.

● The FMCG sector is expanding in emerging nations, where the demand for packaged goods is fueled by increased disposable incomes and shifting lifestyles.

● Some FMCG firms have a track record of paying dividends and returning value to shareholders, which can give investors consistent income and long-term capital growth.

Therefore, before selecting FMCG stocks to buy, considering the above reasons can be wise for investors looking for consistency, predictability, and future growth in emerging economies. However, before making any investment selections, it is crucial to undertake careful study and analysis, just as with any other investment.

Top 10 FMCG Stocks to Invest in India

According to market size and financial performance, these are the top FMCG company stocks in India to buy:

|

Company Name |

Industry |

|

Hindustan Unilever Limited |

Personal Care |

|

Nestle India Limited |

Food and Beverage |

|

Britannia Industries Limited |

Food and Beverage |

|

Godrej Consumer Products Limited |

Personal Care |

|

Dabur India Limited |

Personal Care |

|

Marico Limited |

Personal Care |

|

Colgate-Palmolive (India) Limited |

Personal Care |

|

Procter & Gamble Hygiene and Health Care Limited |

Personal Care |

|

ITC Limited |

Food and Beverage, Personal Care |

|

Jubilant Foodworks Limited |

Food and Beverage |

Factors to Consider Before Investing in FMCG related Stocks in India

There are several things that investors should take into consideration before investing in top FMCG stocks in India. Here are a few crucial reminders:

1. Business Financials: Before purchasing stock in a firm, it's critical to review its financial standing. Investors should consider variables including revenue expansion, profitability, degree of debt, and return on equity. Long-term returns are more likely to be steady for a corporation with a solid financial track record.

2. Market Position: An important issue is a company's market position within its industry. Investors want to consider the business's market share, brand strength, and competitive advantage. Strong market positions increase a company's ability to withstand economic downturns and produce long-term profits.

3. Consumer Trends: Consumer trends and preferences significantly impact FMCG companies. Investors must stay informed about shifting consumer trends and how they affect the market. For instance, a trend towards healthy eating may be advantageous for businesses that provide natural and organic goods.

4. Valuation: It's important to consider how much a company's stock is worth. To ascertain whether the stock is trading at a fair price, investors should consider the company's price-to-earnings ratio (P/E ratio) and price-to-sales ratio (P/S ratio). An overvalued stock may be indicated by a high P/E ratio, while a low P/E ratio may indicate an undervalued stock.

5. An Environment of Regulation: In India, FMCG companies must abide by a wide number of rules, including those about food safety, packaging and labelling specifications, and advertising guidelines. Any regulatory concerns that can affect the company's business operations or future growth possibilities should be known to investors.

To make educated investment decisions, investors need to carefully consider the company's financials, market position, consumer trends, valuation, and regulatory environment before investing in FMCG-related companies in India. Before making any investment decisions, careful research and analysis should be done.

Segments of the FMCG Stocks

The Fast-Moving Consumer Goods (FMCG) industry is divided into several segments, each with distinctive traits and market dynamics. The following are some of the good FMCG stock sectors:

● Food and Beverage: This segment comprises businesses that manufacture and market packaged foods and drinks, such as juices, ready-to-eat meals, snacks, and carbonated beverages.

● Personal Care: This market category comprises businesses that manufacture and distribute personal care items such as cosmetics, skincare, hair care, and oral hygiene products.

● Household Care: This market category consists of businesses that manufacture and distribute cleaning supplies for the home, including floor cleaners, dishwashing solutions, and detergents.

● Tobacco: This industry comprises businesses that manufacture and market tobacco goods, such as cigarettes and cigars.

● Healthcare: This industry segment comprises businesses that manufacture and market healthcare goods such as over-the-counter drugs, vitamins, and dietary supplements.

● Baby and childcare: This business manufactures and markets items such as diapers, baby food, and toys for newborns and young children.

● Pet Care: This market category comprises businesses that manufacture and distribute pet food and accessories.

Each segment's performance and development potential might change depending on various variables, including consumer patterns, prevailing economic conditions, and the regulatory climate. Before making an investment decision, investors should undertake in-depth research and analysis on the particular segment(s) they are interested in.

Performance Overview of FMCG Stocks List

1. Hindustan Unilever Limited (HUL)

Hindustan Unilever Limited (HUL) is one of the best FMCG stocks to buy in India, with a strong portfolio of brands in personal care, home care, and food and refreshment categories. Here are some key financial ratios for the company, based on its latest financial statements:

● Market Cap: INR 6.22 trillion

● Face Value: INR 1

● EPS (Earnings Per Share): INR 70.17

● Book Value: INR 39.34

● RoCE (Return on Capital Employed): 102.4%

● RoE (Return on Equity): 97.6%

● Debt to Equity: 0.00

● Stock PE (Price-to-Earnings) Ratio: 83.98

● Dividend Yield: 1.17%

● Promoter’s Holdings (%): 67.19%

Nestle India has a sound financial standing and has a history of giving its stockholders positive returns. Its high RoCE and RoE ratios show effective capital management and significant profitability. Here are some key financial ratios for Nestle India Limited, based on its latest financial statements:

● Market Cap: INR 1.97 trillion

● Face Value: INR 10

● EPS (Earnings Per Share): INR 248.60

● Book Value: INR 251.13

● RoCE (Return on Capital Employed): 161.6%

● RoE (Return on Equity): 110.2%

● Debt to Equity: 0.00

● Stock PE (Price-to-Earnings) Ratio: 75.11

● Dividend Yield: 1.47%

● Promoter’s Holdings (%): 63.59%

3. Britannia Industries Limited

A well-known Indian food firm, Britannia Industries Ltd, manufactures and sells biscuits, bread, cakes, rusk, and dairy items. The company's headquarters are in Kolkata, India, and it was established in 1892. Here are some key financial ratios for Britannia Industries Ltd, based on its latest financial statements:

● Market Cap: INR 103,526 crores ($13.9 billion)

● Face Value: INR 1 per share

● EPS: INR 86.22

● Book Value: INR 285.84

● ROCE: 39.83%

● ROE: 34.57%

● Debt to Equity: 0.05

● Stock PE: 49.71

● Dividend Yield: 1.19%

● Promoter’s Holdings (%): 50.89%

4. Godrej Consumer Products Limited

An Indian company called Godrej Consumer Products Ltd produces and sells goods in a number of areas, such as personal care, home goods, and hair care. Here are some key financial ratios for Godrej Consumer Products Ltd, based on its latest financial statements:

● Market Cap: INR 77,334 crores ($10.4 billion)

● Face Value: INR 1 per share

● EPS: INR 14.59

● Book Value: INR 48.68

● ROCE: 17.34%

● ROE: 16.44%

● Debt to Equity: 0.07

● Stock PE: 56.25

● Dividend Yield: 0.85%

● Promoter’s Holdings (%): 61.13%

Among the many products that Dabur India Ltd manufactures and sells are meals, personal care items, home care items, and health supplements. The company's headquarters are in Ghaziabad, India, established in 1884. Here are some key financial ratios for Dabur India Ltd, based on its latest financial statements:

● Market Cap: INR 1,08,786 crores ($14.7 billion)

● Face Value: INR 1 per share

● EPS: INR 11.33

● Book Value: INR 29.12

● ROCE: 24.63%

● ROE: 22.95%

● Debt to Equity: 0.09

● Stock PE: 64.51

● Dividend Yield: 0.78%

● Promoter’s Holdings (%): 66.47%

Marico Limited is an Indian consumer goods company that produces and markets products in the health and beauty segments. The company was founded in 1988 and is headquartered in Mumbai, India. Here are some key financial ratios for Marico Limited, based on its latest financial statements:

● Market Cap: INR 62,404 crores ($8.4 billion)

● Face Value: INR 1 per share

● EPS: INR 7.67

● Book Value: INR 26.35

● ROCE: 42.06%

● ROE: 27.55%

● Debt to Equity: 0.00

● Stock PE: 59.16

● Dividend Yield: 0.76%

● Promoter’s Holdings (%): 60.22%

7. Colgate-Palmolive (India) Limited

Leading Indian manufacturer and distributor of dental care, personal care, and home care products is Colgate-Palmolive (India) Limited. The business is a division of the US-based, multinational consumer goods corporation Colgate-Palmolive Company. Here are some key financial ratios for Colgate-Palmolive (India) Limited, based on its latest financial statements:

● Market Cap: INR 44,204 crores ($5.9 billion)

● Face Value: INR 1 per share

● EPS: INR 26.98

● Book Value: INR 33.71

● ROCE: 87.43%

● ROE: 44.79%

● Debt to Equity: 0.00

● Stock PE: 42.17

● Dividend Yield: 0.79%

● Promoter’s Holdings (%): 51.87%

8. Procter and Gamble Hygiene and Health Care Limited

Procter and Gamble Hygiene and Health Care Limited is an Indian consumer goods company that produces and markets a range of products, including feminine care, baby care, and healthcare products. The company is a subsidiary of Procter & Gamble, a global consumer goods company headquartered in the US. Here are some key financial ratios for Procter and Gamble Hygiene and Health Care Limited, based on its latest financial statements:

● Market Cap: INR 47,848 crores ($6.4 billion)

● Face Value: INR 10 per share

● EPS: INR 147.27

● Book Value: INR 129.23

● ROCE: 95.84%

● ROE: 118.57%

● Debt to Equity: 0.00

● Stock PE: 81.60

● Dividend Yield: 0.64%

● Promoter’s Holdings (%): 69.55%

ITC Limited is an Indian conglomerate that operates in a range of industries, including FMCG, hospitality, paper and packaging, and agribusiness. The company was founded in 1910 and is headquartered in Kolkata, India. Here are some key financial ratios for ITC Limited, based on its latest financial statements:

● Market Cap: INR 2,89,163 crores ($38.9 billion)

● Face Value: INR 1 per share

● EPS: INR 11.36

● Book Value: INR 29.25

● ROCE: 25.18%

● ROE: 22.01%

● Debt to Equity: 0.11

● Stock PE: 21.94

● Dividend Yield: 4.18%

● Promoter’s Holdings (%): 14.98%

10. Jubilant Foodworks Limited

Jubilant Foodworks Limited is an Indian company that operates the franchise of Domino's Pizza in India, Nepal, Sri Lanka, and Bangladesh. The company was founded in 1995 and is headquartered in Noida, India. Here are some key financial ratios for Jubilant Foodworks Limited, based on its latest financial statements:

● Market Cap: INR 39,343 crores ($5.3 billion)

● Face Value: INR 10 per share

● EPS: INR 43.54

● Book Value: INR 65.16

● ROCE: 39.66%

● ROE: 33.17%

● Debt to Equity: 0.00

● Stock PE: 65.79

● Dividend Yield: 0.45%

● Promoter’s Holdings (%): 49.93%

Here is a list of best fmcg stocks to buy now with their stats:

|

Company Name |

Net Sales |

EBITDA |

Net Profit |

EBITDA Margin |

Net Profit Margin |

|

Hindustan Unilever Limited |

40,079 |

10,000 |

7,787 |

25.00% |

19.43% |

|

Nestle India Limited |

13,326 |

3,331 |

2,948 |

25.00% |

22.13% |

|

Britannia Industries Limited |

12,858 |

2,051 |

1,635 |

15.95% |

12.71% |

|

Godrej Consumer Products Limited |

9,110 |

1,694 |

1,347 |

18.62% |

14.79% |

|

Dabur India Limited |

9,058 |

1,908 |

1,540 |

21.06% |

17.01% |

|

Marico Limited |

6,182 |

1,045 |

973 |

16.92% |

15.73% |

|

Colgate-Palmolive (India) Limited |

4,607 |

1,098 |

891 |

23.81% |

19.33% |

|

Procter & Gamble Hygiene and Health Care |

3,947 |

1,032 |

826 |

26.12% |

20.91% |

|

ITC Limited |

56,000 |

17,000 |

12,461 |

30.36% |

22.24% |

|

Jubilant Foodworks Limited |

4,796 |

1,053 |

953 |

21.98% |

19.89% |

Conclusion

In conclusion, India's FMCG industry still has much room for expansion, with leaders in net sales and profitability including Hindustan Unilever, Nestle, and ITC. These leading FMCG stocks are well-positioned for continuing success in 2023 and beyond because of shifting customer tastes and an expanding middle class; they are becoming the best fmcg stocks to buy in India 2023.

FAQs on FMCG Stocks 2023

Which Indian Companies are investing in the FMCG Sector?

Some Indian companies investing in the FMCG sector include ITC, Dabur India, Marico, Nestle, Britannia, HUL and Godrej Consumer Products. These are the best fmcg stocks 2023.

What is the future of FMCG in India?

The FMCG sector in India is expected to continue its growth trajectory, driven by factors such as changing consumer behavior, increasing disposable incomes, and technological advancements.

Who is the largest manufacturer of FMCG Stocks in India?

Hindustan Unilever Limited (HUL) is currently the largest manufacturer of FMCG stocks in India, with a wide range of products and a strong distribution network.

Is the FMCG sector stocks a good investment?

The FMCG sector stocks have historically provided stable returns and are considered a safe investment option, making them a good choice for long-term investors.

How can I invest in FMCG stocks using the 5paisa App?

With the 5paisa app, one may look for the best FMCG stocks to buy and sell, utilizing the trading platform after creating an account, completing the KYC procedure, and adding funds.

Trending on 5paisa

Discover more of what matters to you.

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Ruchit Jain

Ruchit Jain Sachin Gupta

Sachin Gupta 5paisa Research Team

5paisa Research Team