Handling money is a bit of circus sometimes. Lets agree to that . People want their cash to be safe, growing but not locked up. Stocks and Mutual funds are exciting but not everyone is comfortable with market ups and downs. That’s where That’s where fixed-income instruments like Non-Convertible Debentures (NCDs) come into the picture.Sounds fancy, but really, it’s just a way to park your money somewhere it won’t throw tantrums every other day. Steady, predictable, and honestly, a bit of a relief if you’re over the whole “will my savings evaporate today?” anxiety.

What are Non Convertible Debentures?

Non convertible Debentures are basically you lending your cash to a company, not a bank. They promise to pay you interest on the regular, and then, after a set time, they give your original money back. They are similar to fixed deposit, but instead of trusting a bank, you’re betting on a company to not blow it. And “non-convertible” just means you’re never getting company shares out of the deal; it’s pure debt, no surprise equity move later. Simple as that.

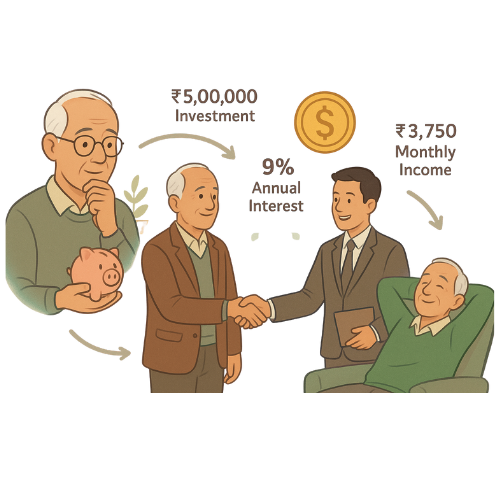

To understand better lets take an non covertible debenture example

Suppose your neighbour who recently retired wants to earn a steady monthly income without taking too much risk. Instead of putting all his savings into a bank fixed deposit, he invests ₹5 lakhs in a secured NCD issued by a reputed housing finance company. The Non covertible debentures offers 9% annual interest, paid monthly. Now, he receives ₹3,750 every month, which helps him manage his household expenses comfortably, while his principal remains safe and will be returned after five years.

For many investors, especially those looking for predictable income, NCDs offer a practical alternative. They are issued by companies to raise funds for various business needs, and in exchange, they offer attractive interest rates, often higher than what banks provide on fixed deposits. Some Non convertible Debentures are even listed on stock exchanges, which means you can buy or sell them before maturity if needed.

But like any financial product, Non Convertible Debentures come with their own set of features, benefits, and risks. There are different types, secured and unsecured, and each has its own level of safety. Understanding how they work, who can invest, and what to look out for can help you make informed decisions.

Let’s now explore the two main types of Non-Convertible Debentures—Secured and Unsecured

Types of Non Convertible Debentures (NCDs)

The meaning of non convertible debentures lies in their role as fixed-income instruments issued by companies to raise capital, where investors receive regular interest but do not gain any ownership rights. These debentures cannot be converted into equity shares, making them distinct from convertible ones. To attract investors, companies often offer higher interest rates on NCDs. They may be secured, backed by company assets, or unsecured, depending on the issuer’s credit profile. In India, Non Convertible Debentures are regulated by SEBI, and at maturity, investors get back their principal along with any due interest. Let us understand Types od Non convertible debentures in detail.

Non-Convertible Debentures are broadly classified into two types based on the level of security they offer to investors:

Secured NCDs

Think if you are lending money to a friend who gives you their gold jewellery as collateral. If they don’t repay, you have something valuable to recover your money. This is exactly secured Non Convertible Debentures . Secured NCDs are backed by the assets of the issuing company. If the company fails to repay the investors, its assets can be sold to recover the dues. This makes secured Non Convertible Debentures relatively safer compared to unsecured ones.

Key Features:

- Lower risk due to asset backing

- Generally preferred by conservative investors

- Slightly lower interest rates compared to unsecured NCDs

Example :

In 2025 , Tata Capital issued secured NCDs with a tenure of 5 years and a coupon rate of 7.5% per annum.These debentures were backed by the company’s loan receivables and other financial assets. Suppose an conservative investor who is nearing retirement chose to invest in this NCD . For him this is an apt investment because of the low risk profile knowing that if Tata Capital ever defaulted, its pledged assets could be liquidated to repay investors. While the interest rate was slightly lower than some market alternatives, the security of asset backing gave him peace of mind and predictable returns.

Unsecured NCDs

Unsecured NCDs are not backed by any specific assets. If the issuing company defaults, investors have no direct claim on its assets. These NCDs carry higher risk but may offer better returns to compensate.

Key Features:

- Higher risk due to lack of collateral

- Suitable for investors willing to take calculated risks

- Often offer higher interest rates

Example

Suppose if Muthoot Finance, one of India’s leading gold loan NBFCs, issued unsecured NCDs in 2023 to raise capital for lending operations. These NCDs were part of a public issue and listed on stock exchanges. Suppose, a mid-career investor, chose to invest ₹2 lakh in the 60-month option with annual interest payouts. He was attracted by the higher interest rate compared to bank FDs. However, he understood that since these NCDs were unsecured, he wouldn’t have any direct claim on Muthoot’s assets if the company defaulted.

Key Benefits of NCDs

- Fixed and Predictable Returns: NCDs offer a pre-determined interest rate, which means you know exactly how much you’ll earn. This is ideal for those who prefer stability over market-linked returns. For example a retiree investing ₹5 lakhs in an Non Convertible Debentures offering 9% annual interest can expect ₹45,000 per year, helpful for budgeting monthly expenses.

- Higher Interest Rates than Bank FDs: Non Convertible Debentures often provide better returns than traditional fixed deposits, especially when issued by well-rated companies. For examplea bank FD may offer 6.5%, a secured NCD from a housing finance company might offer 8.75% for the same tenure.

- Tradability on Stock Exchanges: Listed Non Convertible Debentures can be bought or sold before maturity, offering liquidity that most fixed deposits lack. For example If an investor needs funds urgently, they can sell their NCDs on the exchange instead of waiting for maturity.

- Diversification in Portfolio: Non Convertible Debentures add a fixed-income component to your investment mix, balancing the risk from equities or mutual funds.

- Flexible Tenure Options: Investors can choose NCDs with tenures ranging from 1 to 10 years, depending on their financial goals.

Risks of NCDs

- Credit Risk (Default Risk):

If the issuing company faces financial trouble, it may fail to pay interest or return the principal. For example an investor in an unsecured NCD from a low-rated company may lose money if the company goes bankrupt.

- Interest Rate Risk:

If market interest rates rise, the value of existing NCDs may fall in the secondary market, affecting resale value. For example an NCD offering 8% may become less attractive if new issues offer 9%, reducing its market price.

- Liquidity Risk

Not all Non Convertible Debentures are actively traded. Selling them before maturity may be difficult or may require accepting a lower price.

- Taxation on Interest Income

Interest earned from Non Convertible Debentures is fully taxable as per your income slab, which can reduce net returns for investors in higher tax brackets.

- No Early Withdrawal Option

Unlike bank FDs, you cannot prematurely redeem Non Convertible Debentures with the issuer. Your only exit is through the secondary market, if listed.

Non Convertible Debenture Example

Suppose you invest ₹10,00,000 in a secured NCD issued by a reputed housing finance company. The NCD offers a fixed interest rate of 9% per annum for a tenure of three years. This means:

- You’ll receive ₹90,000 in interest every year (₹10,00,000 × 9%).

- The interest may be paid monthly, quarterly, or annually depending on the terms.

- At the end of three years, you’ll get back your ₹10,00,000 principal.

This setup is ideal for someone who wants regular income without the unpredictability of stock markets. For instance, a retired individual might use the monthly interest payments to cover household expenses, while keeping the principal safe for future needs.

Difference Between Fixed Deposits and Non Convertible Debentures

Feature | Fixed Deposits (FDs) | Non Convertible Debentures (NCDs) |

Issuer | Banks and NBFCs | Corporates and NBFCs |

Nature of Instrument | Deposit product | Debt security |

Return Type | Fixed interest | Fixed or floating interest |

Risk Level | Low (especially with scheduled banks) | Moderate to high (depends on issuer’s credit rating) |

Regulatory Oversight | Regulated by RBI | Regulated by SEBI |

Credit Rating | Not mandatory | Mandatory (e.g., CRISIL, ICRA ratings) |

Liquidity | Premature withdrawal allowed (with penalty) | Tradable on exchanges (if listed); no early redemption |

Tenure Range | Typically 7 days to 10 years | Usually 1 to 10 years |

Taxation on Interest | Taxable as per slab; TDS applicable | Taxable as per slab; no TDS if held in Demat form |

Security | Often secured by deposit insurance (up to ₹5 lakh) | Can be secured or unsecured depending on structure |

Suitability | Conservative investors seeking capital safety | Investors seeking higher returns with credit awareness |

How to Invest in Non-Convertible Debentures (NCDs)

Investing in NCDs is a straightforward process, but it’s important to understand the two main routes through which you can purchase them:

- Investing Through the Primary Market

This means buying NCDs directly when a company issues them to the public.

Steps:

- Watch for public issue announcements from companies

- Apply through your broker, bank, or online trading platform

- You’ll need a Demat account and PAN card to apply.

- Once allotted, the NCDs are credited to your Demat account.

- Buying from the Secondary Market

This involves purchasing NCDs that are already listed and being traded on stock exchanges like NSE or BSE.

Steps:

- Log in to your trading account.

- Search for listed NCDs using their ISIN or company name.

- Review price, yield, and credit rating.

- Place a buy order just like you would for shares.

What to Check Before Investing in NCDs

Before committing your money to any NCD, it’s essential to evaluate a few key factors that determine both the safety and suitability of the investment. Here’s what to look for:

- Credit Rating

Credit ratings are issued by agencies like CRISIL, ICRA, and CARE, and they reflect the issuer’s ability to repay its debt. Ratings range from AAA (highest safety) to D (default). A higher rating means lower risk. Just like a good CIBIL score improves your chances of getting a loan, a high credit rating indicates that the company is financially stable and more likely to honour its commitments. Stick to NCDs rated AA and above, especially if you’re a conservative investor.

- Issuer’s Financial Health

Beyond ratings, review the company’s financials, debt levels, cash flow, profitability, and interest coverage ratio. These metrics show whether the company can comfortably pay interest and repay principal. Ratings can change. A company with strong financials is less likely to default, even if market conditions shift.

- Interest Payment Frequency

NCDs may pay interest monthly, quarterly, or annually. Choose a frequency that aligns with your cash flow needs. If you rely on regular income say, for household expenses, monthly payouts may be more suitable than annual ones.

- Tenure

NCDs can range from 1 to 10 years. Match the maturity period with your financial goals. Longer tenures may offer higher returns but also expose you to more interest rate and credit risk over time.

- Liquidity

Check if the NCD is listed on a stock exchange. Listed NCDs can be sold before maturity, offering flexibility. Unlisted NCDs are non-liquid, you may not be able to exit early unless the issuer offers a buyback.

Who Can Invest in NCDs

Category | Eligibility Notes |

Resident Individuals | Most common investors; can invest via demat account during public issue or secondary market |

HUFs (Hindu Undivided Families) | Eligible to invest, often for Long-term income planning |

Companies & Corporates | Can invest for treasury management or fixed income diversification |

Banks & Financial Institutions | Often invest in high-rated NCDs for yield enhancement |

Trusts & Societies | Subject to investment policy and regulatory compliance |

NRIs (Non-Resident Indians) | Allowed in select NCD issues, depending on RBI and issuer guidelines |

Unincorporated Bodies | Permitted if registered in India |

Upcoming NCDs and Interest Rates

Issuer | Open Date | Close Date | Issue Size | Credit Rating |

Sakthi Finance | 8 Aug 2025 | 22 Aug 2025 | ₹75 Cr | ICRA BBB |

ICL Fincorp Ltd | 31 Jul 2025 | 13 Aug 2025 | ₹500 Cr | CRISIL BBB- |

Sakthi Finance NCD – August 2025

Tenure | Payment Type | Coupon Rate (p.a.) | Effective Yield (p.a.) |

24 months | Monthly | 9.00% | 9.00% |

24 months | Cumulative | — | 9.31% |

36 months | Monthly | 9.00% | 9.00% |

36 months | Cumulative | — | 9.31% |

60 months | Monthly | 10.25% | 10.25% |

60 months | Cumulative | — | 10.65% |

85 months | Cumulative | — | 10.38% |

Sakthi Finance NCD Issue

- Open Date : August 8, 2025

- Close Date : August 22, 2025

- Issue Size : ₹75 crore (base) with ₹75 crore over-subscription option (total ₹150 crore)

- Interest Rates: Up to 10.65% per annum (for cumulative options)

- Types Offered: Secured NCDs with both monthly and cumulative interest options

- Credit Rating: ICRA BBB (Stable)

ICL Fincorp NCD – August 2025

Tenure | Payment Type | Coupon Rate (p.a.) | Effective Yield (p.a.) |

13 months | Monthly | 10.50% | 11.02% |

24 months | Monthly | 11.00% | 11.57% |

36 months | Monthly | 11.50% | 12.13% |

60 months | Monthly | 12.00% | 12.68% |

68 months | Cumulative | — | 12.62% |

ICL Fincorp NCD Issue

- Open Date: July 31, 2025

- Close Date: August 13, 2025

- Issue Size: ₹500 crore (base)

- Interest Rates (Coupon): 50% to 12.00% (depending on the tranche)

- Credit Rating: CRISIL BBB- / Stable

- Minimum Investment: ₹10,000

Conclusion

- Non Convertible Debentures (NCDs) offer a compelling option for investors seeking fixed returns with varying levels of risk. Whether you’re a retiree looking for regular income, a professional aiming to diversify your portfolio, or someone exploring alternatives to traditional fixed deposits, NCDs can serve as a practical solution.

- They combine the predictability of fixed interest with the flexibility of tradability, especially if listed on exchanges. However, like any financial instrument, they require careful evaluation. Factors such as credit rating, issuer reputation, tenure, and liquidity play a crucial role in determining whether an NCD aligns with your financial goals.

- By understanding the types of Non Convertible Debentures, how they work, and what to consider before investing, you can make informed decisions that balance safety and returns. With proper due diligence, NCDs can be a valuable addition to your investment strategy, offering stability in an otherwise volatile financial landscape.

Frequently Asked Questions

NCDs from highly rated issuers (AAA or AA) are generally considered safe. Secured NCDs offer additional protection through asset backing. However, all investments carry some level of risk, so it’s important to assess the issuer’s financial health.

Yes, if the NCD is listed on a stock exchange (NSE or BSE), you can sell it in the secondary market. Keep in mind that market prices may vary based on interest rate movements and demand.

Interest earned from NCDs is taxed as per your income tax slab. If you sell the NCD before maturity, capital gains tax may apply—short-term or long-term depending on the holding period.

It varies by issuer, but most public issues allow retail investors to start with as little as ₹10,000 to ₹25,000.

NCDs are suitable for investors looking for fixed returns, such as retirees, conservative investors, or those seeking to diversify beyond equities and mutual funds

The offer document or prospectus will mention whether the NCD is listed. You can also check on NSE or BSE platforms using the ISIN or company name.

NCDs from highly rated issuers (AAA or AA) are generally considered safe. Secured NCDs offer additional protection through asset backing. However, all investments carry some level of risk, so it’s important to assess the issuer’s financial health.

Yes, if the NCD is listed on a stock exchange (NSE or BSE), you can sell it in the secondary market. Keep in mind that market prices may vary based on interest rate movements and demand.

Interest earned from NCDs is taxed as per your income tax slab. If you sell the NCD before maturity, capital gains tax may apply—short-term or long-term depending on the holding period.

It varies by issuer, but most public issues allow retail investors to start with as little as ₹10,000 to ₹25,000.

NCDs are suitable for investors looking for fixed returns, such as retirees, conservative investors, or those seeking to diversify beyond equities and mutual funds

The offer document or prospectus will mention whether the NCD is listed. You can also check on NSE or BSE platforms using the ISIN or company name.