Content

- What is Cyclical Stock?

- How Cyclical Stocks Work?

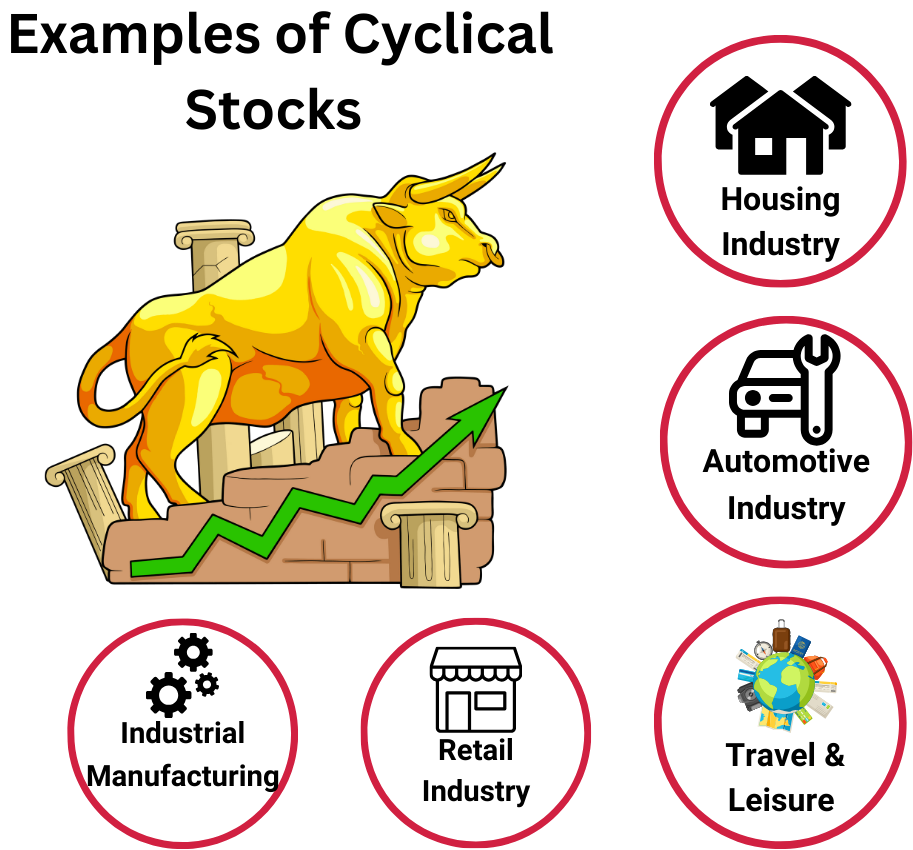

- Example of Cyclical Stocks

- Interdependence of Cyclical Stocks and the Business Cycle

- Advantages of Cyclical Shares

- Limitations of Cyclical Securities

- Cyclical Vs. Non-Cyclical Stocks

- Taxation on Cyclical Stocks

- Suitability of Cyclical Stocks

- Different Cycles and Their Stocks

- When to Invest in Cyclical Shares?

- Conclusion

A cyclical stock is one whose price is influenced by systematic or macroeconomic shifts in the overall economy. Cyclical stock is well known for tracking an economy's boom, peak, recession, and recovery phases. The majority of cyclical stocks belong to businesses that sell consumer discretionary goods, which consumers tend to spend more on during an expansion and less on during a downturn.

This comprehensive guide on cyclical stocks will explore what they are, their benefits, limitations, taxation, suitability, and lots more. We will also discuss the ideal time for investing in cyclical stocks and draw out the difference between cyclical and non-cyclical stocks.

So, whether you are a novice or a seasoned investor, this guide will provide informative insights into this variant of equity. Please keep reading until the end of the article and know how to make informed investment decisions.

Let’s dive in!

More Articles to Explore

- Difference between NSDL and CDSL

- Lowest brokerage charges in India for online trading

- How to find your demat account number using PAN card

- What are bonus shares and how do they work?

- How to transfer shares from one demat account to another?

- What is BO ID?

- Open demat account without a PAN card - a complete guide

- What are DP charges?

- What is DP ID in a demat account

- How to transfer money from demat account to bank account

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Frequently Asked Questions

Usually, consumer banks tend to classify their stocks as cyclical stocks. This is mainly because the demand for their services tends to elevate during periods of increased economic activity.

As falling rates stimulate the economy, cyclical stocks are in the best condition when the interest rates are depreciating. In contrast, cyclical stocks tend to fare poorly during times of rising interest rates.

When the economic outlook seems quite bleak, investors must be ready to unload the cyclical stocks. They must ensure doing so before the stocks tumble and return to exactly where they started.

Investors stuck with cyclical stocks in India during recessions might need to wait 5 or 15 years for the stocks to return to their previous value.

Cyclical stock is generally affected by macroeconomic or systematic changes in the overall economy. These stocks are extremely well known for following the economic cycles through peal, expansion, recession, and also recovery.

Cyclical stocks in India are quite volatile and tend to follow the most popular economic trends. However, non-cyclical stocks outperform the market during an economic slowdown. In fact, companies with cyclical stocks sell goods and services that are purchased by many when the economy does well.